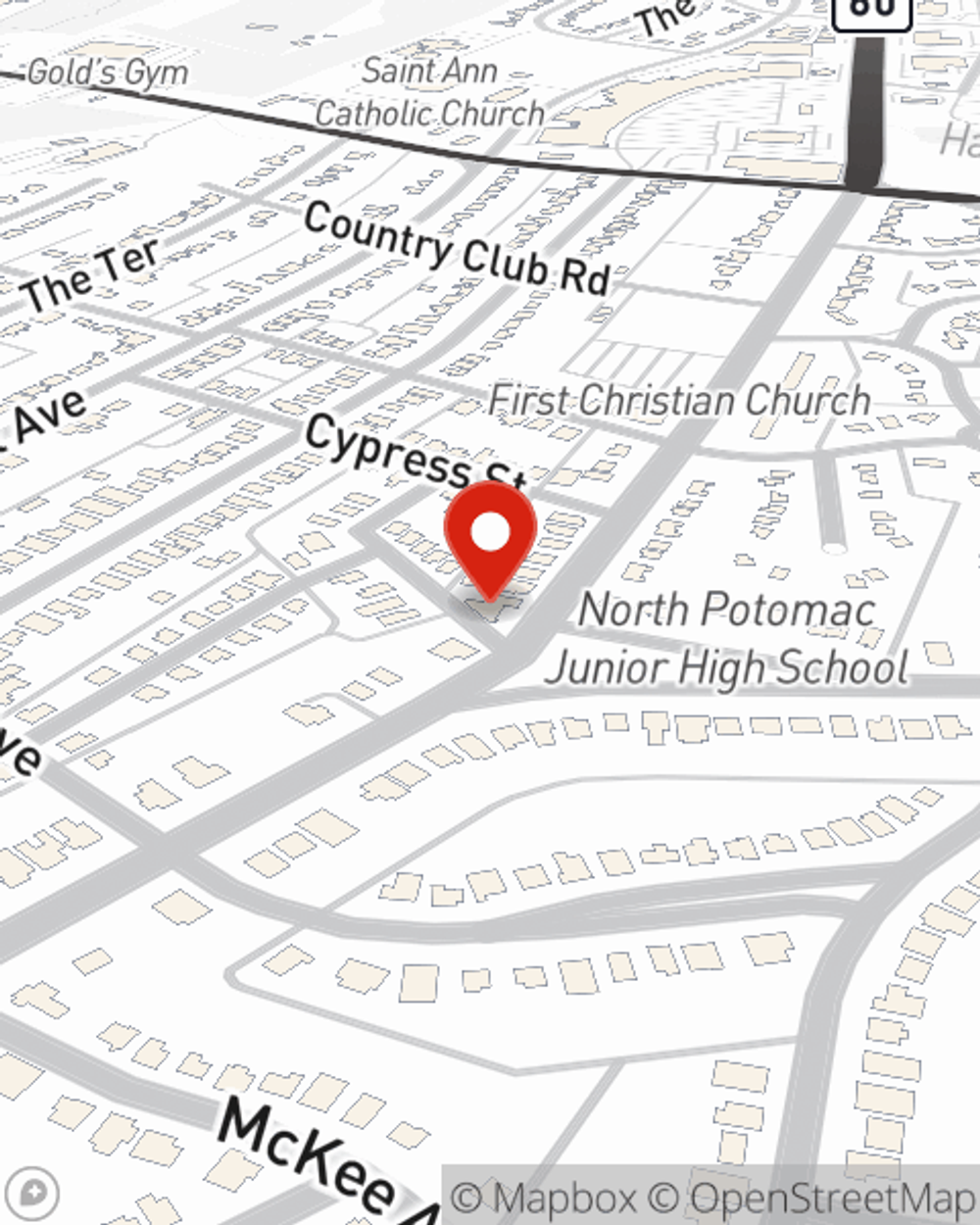

Renters Insurance in and around Hagerstown

Looking for renters insurance in Hagerstown?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Hagerstown Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or condo, renters insurance can be a good idea to protect your stuff, including your video games, linens, couch, tools, and more.

Looking for renters insurance in Hagerstown?

Your belongings say p-lease and thank you to renters insurance

Agent Lauren Brenneman, At Your Service

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Lauren Brenneman can help you with a plan for when the unexpected, like a fire or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Hagerstown renters, are you ready to discuss your coverage options? Contact State Farm Agent Lauren Brenneman today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Lauren at (301) 790-1600 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Lauren Brenneman

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.